Safaricom has partnered with Gulf African Bank to launch a Shari’ah-compliant mobile financial service, Helal Pesa, in Kenya.

According to Tech Weez, the product is the first Shari’ah-compliant mobile and digital solution in the East African country.

Customers accessing financing through the service will receive the amount requested in full with a repayment period of 30 days at a 5% commodity Murabaha margin, according to Tech Weez.

Abdalla Abdulkhalik, MD – Gulf African Bank, said Kenya is now a highly innovative, interconnected, and fast-paced community that requires solutions on the go.

“All our digital offerings including Halal Pesa, seek to directly address this aspect. Our current strategy is focused on digitization for financial inclusion. Our aim is to provide instantaneous access to interest-free credit through Halal Pesa. We are glad that we could partner with a like-minded partner like Safaricom limited to advance this vision,” he said.

According to Business Daily, the bank will shell out up to KSh20,000 ($173,91) and will recover the amount with a 5% margin.

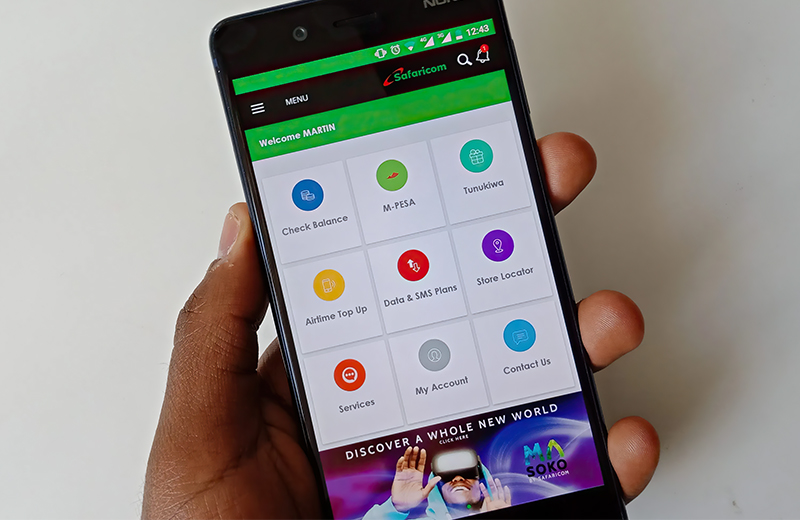

The repayment period on the platform, Helal Pesa, is 30 days. Helal Pesa is built out of Safaricom’s M-PESA platform.

“We remain keen on partnerships that enable us to provide a wide variety of financial solutions that meet the diversified needs of our customers further broadening financial inclusion to ensure that we leave no one behind,” Peter Ndegwa, CEO of Safaricom, said.

“Gulf African Bank is a strategic partner that will enable us to deliver affordable and convenient M-PESA services such as Halal Pesa that are Shariah-compliant in accordance to the Islamic faith,” he said.

The service offers Safaricom an opportunity to reach millions of Muslims with M-Pesa’s credit capability, with the platform’s earlier derivatives locking them out due to charging of interest, according to Business Daily.

By Zintle Nkohla

Follow Zintle Nkohla on Twitter

Follow IT News Africa on Twitter