FNB today announced that it has partnered with AURA, a safety marketplace platform that uses smart auto-dispatch technology, to add GuardMe to its banking app.

FNB banking customers can now access instant emergency response services, anywhere, anytime via the FNB banking app.

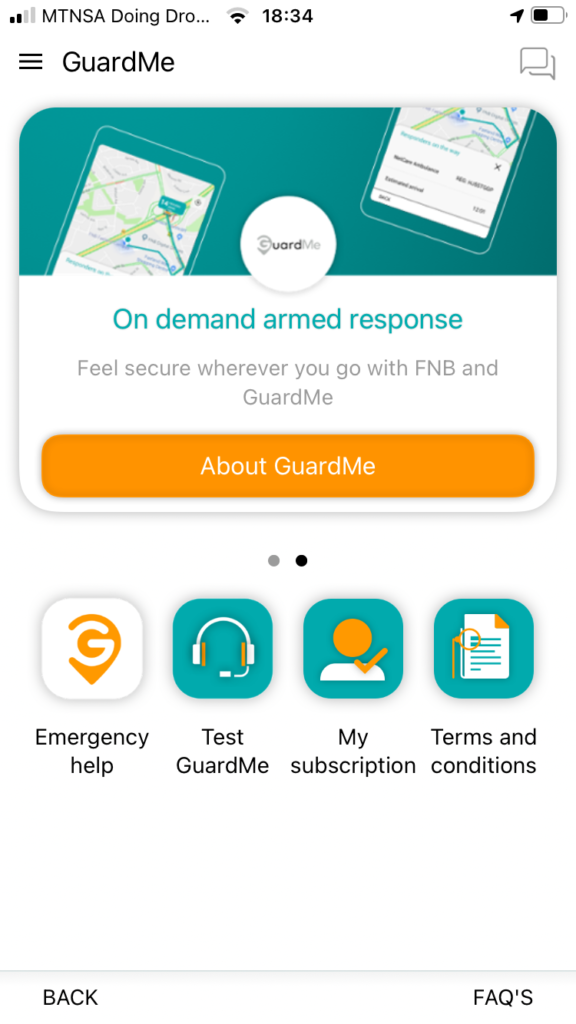

Powered by South Africa’s leading security and medical response marketplace, AURA, the in-app panic button, GuardMe, is available to all FNB customers who register for the service.

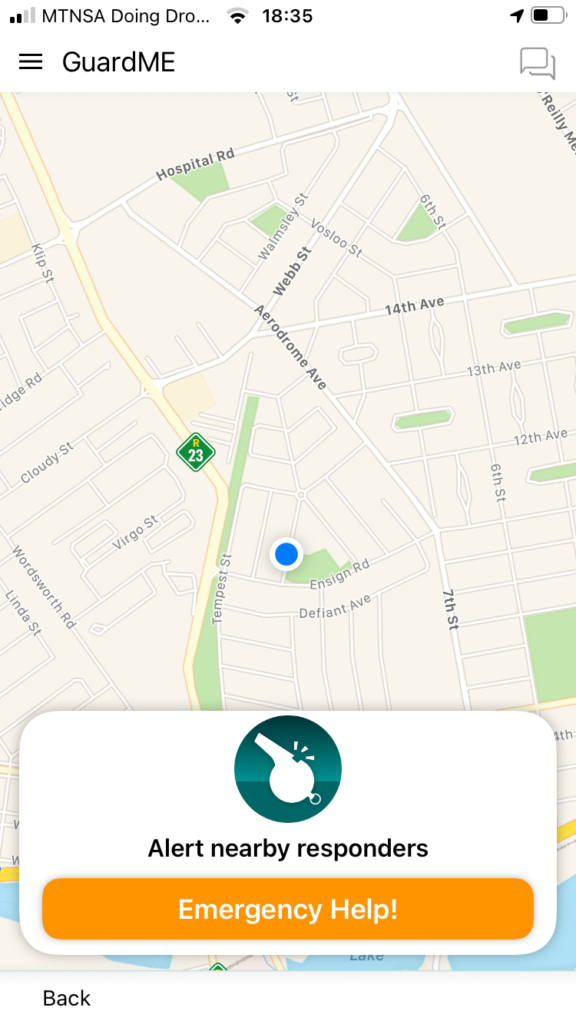

This technology solution allows FNB customers to immediately request rapid mobile emergency responses in the event of an emergency or the threat of a crime such as theft or hijacking. As soon as the panic button is activated, the AURA-powered platform auto-dispatches the closest armed response vehicle to the customer’s location throughout South Africa.

AURA was selected to roll out the service to FNB customers following a successful pilot project as a staff benefit. Founder and CEO Warren Myers says AURA’s technology will ensure FNB customers get the fastest response to an emergency.

“The FNB GuardMe emergency button instantly connects users to AURA’s nationwide network of thousands of armed responders and dispatches the closest vehicle to a distress call,” Myers says.

“What this means is that AURA has distributed thousands of devices which are embedded into the emergency responder’s vehicles. This eliminates the requirements for human operators to find and dispatch a response vehicle to their location. Responders are dispatched and navigated to a customer’s location in an ‘Uberised’ fashion,” Myers explains.

“Currently +-95% of South Africans cannot access effective emergency services. Millions of people suffer crime-related traumas every day and are unable to get the help they need. GuardMe enables anyone with a connected device to access private security wherever they are. In short, we democratise access to emergency services,” he says.

“The safety and security of our customers remains a priority and we are delighted to partner with like-minded organisations that can enable our customers to protect themselves by using the power of our integrated platform,” CEO of FNB eBucks, Johan Moolman, says, commenting on the successful collaboration.

How to activate a distress panic button on your app

FNB and RMB Private Bank customers can register to gain access to 250 armed-response service providers, 2 500 armed-response vehicles, and over 5 000 armed-response personnel via the FNB or RMB Private Bank App. FNB and RMB customers can also sign-up friends and family that don’t bank with FNB/RMB.

Customers can use the FNB or RMB Private Bank App to activate a distress panic button in an emergency without logging in.

This service is free for the first three months and thereafter will cost R 19.90 ($1.36) per month per user. Customers can sign up additional family members and friends as they choose. Additionally, customers can earn up to 100% of their subscription fees back in eBucks (limited to 6 members per month).

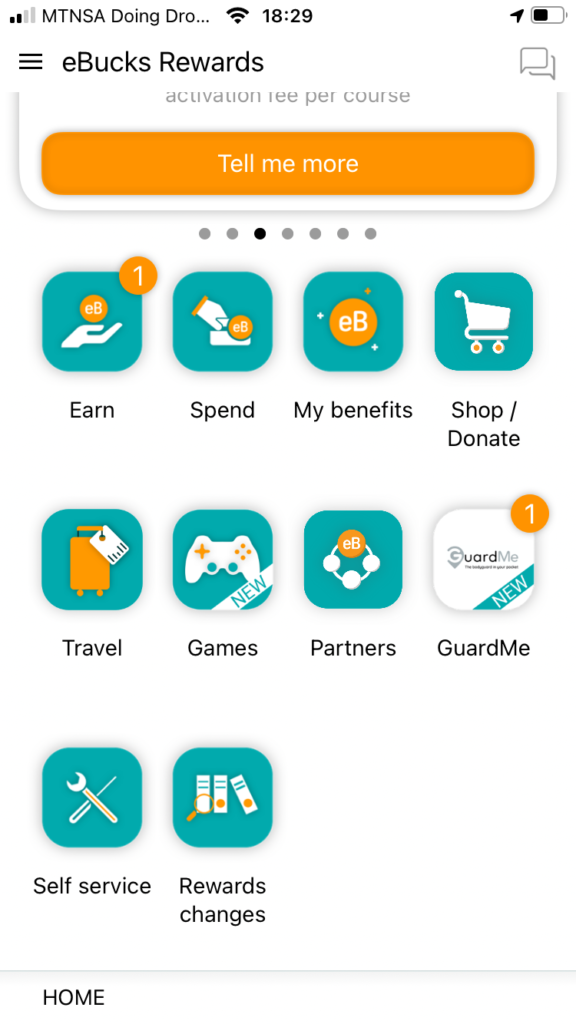

Furthermore, customers can activate this service by selecting the “GuardMe” icon via eBucks on the FNB or RMB Private Bank App.

AURA plans to enhance its service offering with a physical button, so users can activate the service via the app and a button and reduce its response times from an average of five minutes to two or three minutes.

“AURA’s technology aims to make being a criminal extremely difficult. In the very near future, predicting crime will become a reality. By using big data sets, we plan to start proactively moving the response network to deter crime and make impactful arrests,” notes Myers.

FNB customers can register for the GuardMe service via their FNB banking app and will receive the first three months free of charge, after which a nominal monthly fee of R19.00 ($1.30) will apply.

Edited by Zintle Nkohla

Follow Zintle Nkohla on Twitter

Follow IT News Africa on Twitter