Billionaires Crying or “A Long Way Down”

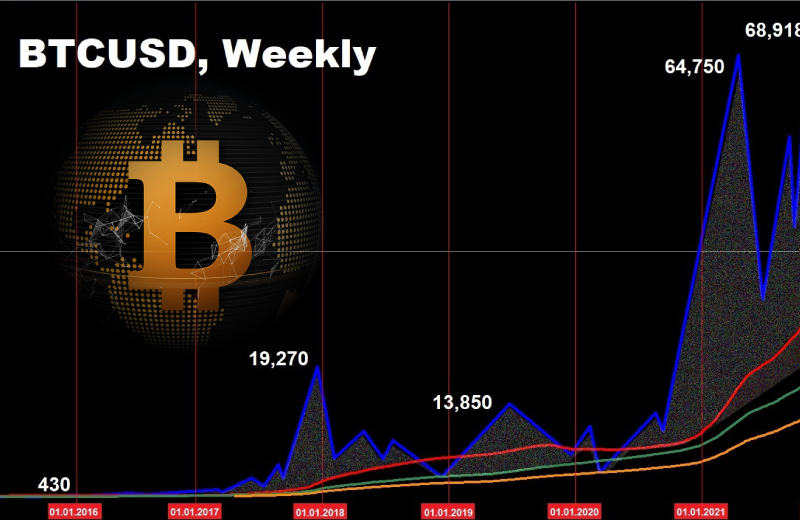

Bitcoin is often referred to as “digital gold”. Back in 2010, BTC was worth 5 cents, and its price reached $69,000 at its peak in November 2021. It is clear that the prospect of quickly and easily turning $100 dollars into $138,000,000 attracted a huge mass of people willing to get rich quickly. So what happened in the last 10-12 years can be called the “Digital Gold Rush”, by analogy with the Gold Rush in the USA in the second half of the 19th century. But then many, instead of getting rich, on the contrary, lost their money. The same can be observed now: bitcoin has returned to the values of December 2020, having lost about 60% of its value in just 6 months.

According to the Bloomberg Billionaires Index, Coinbase CEO Brian Armstrong’s net worth has decreased from $13.7 billion to $2.2 billion. This was not only due to the fall in digital asset prices, but also due to the fall in Coinbase shares, the price of which fell by more than 80%. The capital of the CEO of the FTX crypto exchange Sam Bankman-Fried has halved and now stands at $11.3 billion. The well-known founders of the Gemini cryptocurrency trading platform, the brothers Cameron and Tyler Winklevoss, have individually lost more than $2 billion, which is equivalent to almost 40% of their total fortune.

The Crypto Fear & Greed Index is firmly entrenched in the Extreme Fear zone. And the president of Euro Pacific Capital Peter Schiff predicts the fall of the main cryptocurrency to $8,000. “We have a long way down,” the billionaire wrote.

What to do in such a situation? Of course, you can sit and wait with your hands down. Or you can, for example, engage in active trading. Moreover, by trading on the CFD principle, you can earn both on the growth and fall of the crypto market. Moreover, you do not need to have a real cryptocurrency for this: in order to open a transaction of 1 bitcoin in the NordFX brokerage company, you will only need $150.

So, is it worth missing out on such a great opportunity to get rich when everything is falling apart?

CFDs and Their Advantages

Many traders often wonder how transactions for buying/selling real cryptocurrencies differ from Contract for Difference trading, CFD for short.

To begin with, let’s say that the problem with the above billionaires and millions of other owners of bitcoin and various altcoins is that they bought real coins. (Although, of course, the term “real” doesn’t exactly apply to virtual assets. But for simplicity, we will use it.)

So, if you own real coins, you can make money only if their price rises, and rises above the price at which you bought them. If it falls, you have two options: either pray in the hope that the trend will turn up, or sell the coins and fix the loss. Otherwise, there is a chance to lose everything.

With CFD trading, the situation is much better, since you can earn not only on the growth but also on the fall in the value of the asset. Such online trading at the NordFX broker takes place on the world’s most popular MetaTrader-4 platform without the actual transfer of ownership of the traded asset from the broker to the trader and vice versa. Therefore, this type of online trading is often called non-deliverable.

That is, no matter what asset the trader buys or sells, be it cryptocurrency, currency, gold, stocks or oil, the presence of this product itself is not required. And there is only a difference in the market price of the asset between the moment of the transaction with the broker and the moment of its closing. Simply put, a CFD is a contract, or a legal bet if you prefer, between a trader and a broker, in which:

– the trader fixes the direction of movement of the asset value (buy or sell),

– and if this direction is determined correctly, the broker pays the trader the difference between the asset price at the time of opening the transaction and at the time of its closing,

– if the trader made a mistake with the direction, then it is the trader who incurs losses and pays the broker the corresponding difference in price.

How Much Can One Earn on the Bitcoin Fall?

Note that you can open and close a transaction at any time at your request: 24 hours a day, 7 days a week, 365 days a year. To do this, you just need to select the direction of the transaction, and its volume, and click the appropriate button in the trading terminal window. At the same time, the time between opening trade and closing it can vary from a few moments to several years, it all depends on your decision.

Take as an example the interval from April 01 to April 30, 2022. On April 01, bitcoin was worth 46,500 USD and at this point you open a sell trade, thereby entering into a contract/bet with the broker that says that you think the value of BTC is going to fall.

It is really falling, having reached the level of 38,650 USD on April 30. At this point, after deciding that you have already made good money, you close the trade, and the broker pays you the amount due.

What amount? Let’s do the math.

Suppose you have only 300 USD. In a normal situation, you would be able to open a trade with a maximum of 0.00645 BTC and earn a little more than 50 USD in April. You must admit that this is very good. But with the NordFX broker, you can take advantage of margin trading, thanks to which you only need to have 150 USD in your account to open a 1 BTC trade. With 300 USD, you can make a trade of 2 BTC and earn as much as 15,700 USD.

It sounds fantastic: with 300 USD, you can earn 15,700 USD in just a month, and this despite the fact that bitcoin and the entire crypto market are flying into the abyss! Let’s not hide the fact that this is possible only in an ideal situation. In reality, everything is much more complicated: you need to determine the direction of the transaction correctly, as well as the points of entry and exit from it, calculate its volume in accordance with the rules of money management, and take many other factors into account. And you must always keep in mind that in case of a mistake, you may not earn, but lose your money.

The purpose of this article was just to give you a general understanding of how you can make money in a falling market through CFD and margin trading. At the same time, the brokerage company NordFX makes it possible for you to conclude similar transactions with many fiat currencies, shares of the world’s largest brands, stock indices, oil, gold and silver, as well as with 11 different cryptocurrencies. At the same time, if only 150 USD is needed to open a position of 1 bitcoin, then 1 Ethereum will require 10 times less, 15 USD, 1 EOS – 0.3 USD, and Ripple – 0.02 USD.

By Staff Writer.