Lagos-based fintech PalmPay has today announced that it has reached 10 million users in Nigeria.

The company says that this represents a doubling in its user base within just six months and only 3 years after the company launched in the market. Nigeria is widely known as Africa’s most populous country, with a population of over 206 million individuals according to World Bank and other sources.

PalmPay’s latest milestone in users could roughly represent a 4.89% market share, however, not all Nigerians have access to cellphones or other methods to use fintech such as PalmPay.

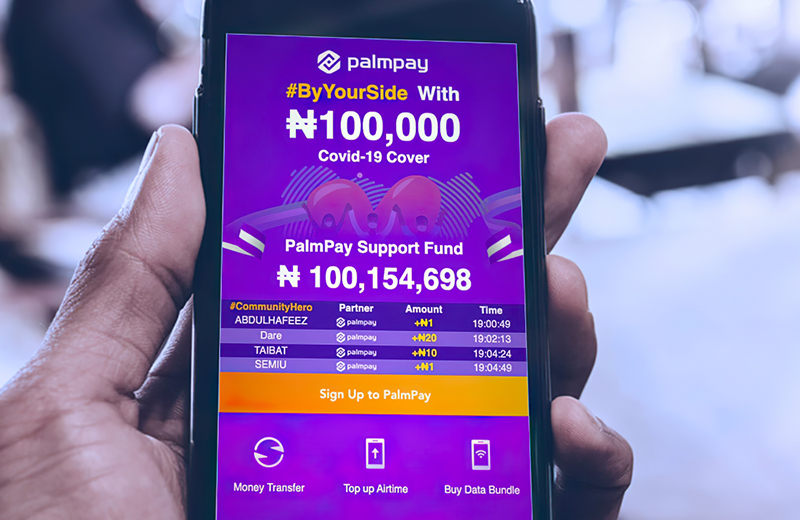

The fintech, which operates under a Mobile Money Operator license from the Central Bank of Nigeria, says it has gained significant traction with its payment app and nationwide agency banking network.

PalmPay says it processes millions of transactions a day, and around 20% of the company’s customer base report that the PalmPay app was their first financial account. If accurate, then this is a boon for financial inclusion in Nigeria, where 36% of the population remains unbanked.

“We are delighted to be able to celebrate this growth milestone and are proud of PalmPay’s track record of making cutting-edge financial services accessible to every Nigerian – including the unbanked,” said Chika Nwosu, MD, PalmPay Nigeria.

“The pandemic has accelerated the shift from cash to digital payments and we are looking forward to continuing to work together with regulators and our partners to innovate to meet the financial needs of consumers.”

“Our significant growth in Nigeria demonstrates PalmPay’s ability to innovate to meet the financial needs of consumers, and we are looking forward to replicating this success as we scale in more markets across Africa,” said Sofia Zab, PalmPay Global CMO.

PalmPay Looks to Increase Safety Awareness for Mobile Money

Last week, PalmPay launched the Wallet Safe Workshop, a monthly campaign for payment security awareness training to help customers improve their overall security knowledge, and learn about how to spot and avoid e-scammers.

Mobile fraud attempts jumped 330% year over year in Nigeria, while web and POS fraud attempts rose 173% and 215% respectively. PalmPay says that it has now become a top priority for financial institutions to guarantee the security of user transactions.

Edited by Luis Monzon

Follow Luis Monzon on Twitter

Follow IT News Africa on Twitter